IFA Consulting Case Study

Background

IFA Consulting is an independent financial advisory firm renowned for its integrity and unwavering commitment to client needs. With a strong focus on financial education, the company delivers tailored solutions designed to guide both individuals and businesses through the complexities and opportunities of today’s economic landscape. The firm offers four main services: Family Office, providing customized wealth management solutions for high-net-worth families; Financial Risk Management, assisting clients in analyzing and mitigating economic risks; Litigation Finance, supporting clients involved in financial legal disputes; and Fairmat, a technological platform ensuring transparency and rigor in financial analysis and practices.

Challenges

Amid the strong performance of crypto assets in recent years, IFA Consulting’s high-net-worth clients sought to diversify their portfolios by investing in digital assets, seen as a reliable store of value. Facing the market’s complexity, the firm recognized the need to partner with a strategic ally sharing its values of transparency and fairness. Ensuring secure access, consistent performance, and a clear regulatory framework was essential to meet client expectations and protect their investments.

The key challenges:

A solution was needed to provide secure access to crypto-assets, while safeguarding the expectations of a high-net-worth clientele accustomed to the reliability and operational standards of traditional finance.

The solution was required to provide low costs while ensuring a high level of transparency, enabling clients to clearly understand every stage of the investment process.

Lacking the technological infrastructure to offer clients direct exposure to digital assets, it was essential to identify a crypto partner capable of delivering fast, flexible, and responsive solutions.

The crypto partner had to combine technical expertise with operational standards typical of traditional finance, offering a secure and reliable service.

Why CheckSig

In light of the sector’s rapid evolution and growing interest in digital assets, IFA Consulting acknowledged the urgency of adopting a prompt and targeted strategy. Consequently, it selected a partner with a robust and flexible crypto infrastructure, capable of delivering secure digital products while fully aligning with IFA’s core values.

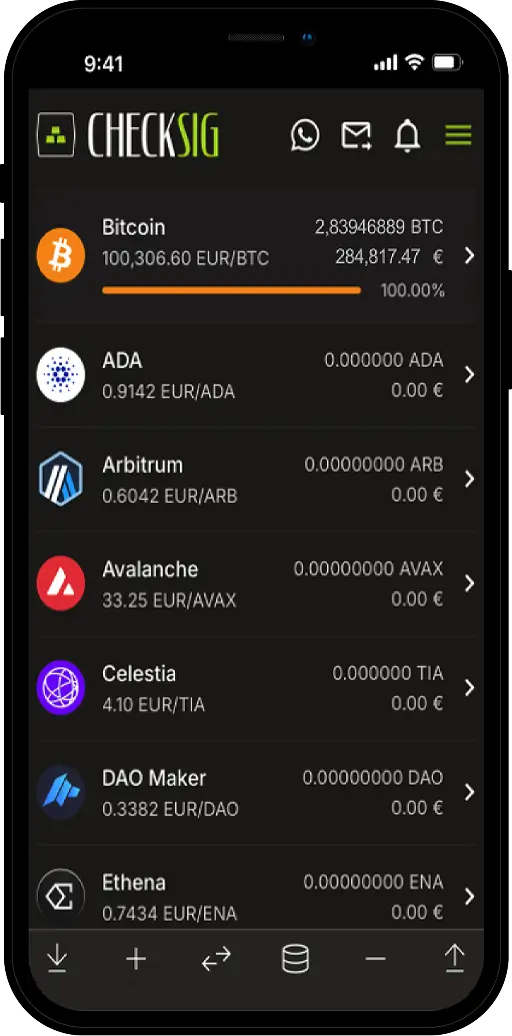

CheckSig was chosen for its stringent Proof-of-Reserves, asset segregation, comprehensive insurance coverage, independent audits, and SOC 1 and SOC 2 Type II certifications. These factors ensure some of the highest levels of security, transparency, and reliability in the crypto sector. Through this partnership, IFA Consulting can provide its clients with secure and transparent access to digital assets, laying the foundation for a solid and responsible investment experience.

Solution

IFA Consulting partnered with CheckSig by adopting the business introduction model, enabling clients to swiftly and securely access crypto solutions. Lacking the internal technological infrastructure to directly support crypto trading, IFA Consulting opted for this approach to reduce complexity and offer a dependable service. Thanks to this collaboration, clients were able to seamlessly access the CheckSig platform, becoming direct clients and benefiting from services that adhere to the highest institutional standards.