Tinaba Case Study

The background

Tinaba is a revolutionary fintech application designed to create a more efficient financial ecosystem. Tinaba’s platform enables users to make payments to businesses and individuals, open savings accounts, manage investments, and raise funds for charities and private ventures.

With the full-service banking solution, customers can also engage in online shopping and expense sharing all through the app. Managing finances should not be difficult, that’s why Tinaba handles it all.

The challenges

To achieve their vision of providing an all-encompassing financial services application, Tinaba understood the need to provide crypto products. However, inherent to the cryptocurrency industry is the complex nature of secure market access and custody, the existence of insecure products and bad actors, and the general lack of clarity regarding regulation in the space.

The key challenges:

Consumer data has shown that clients are not depositing their money on reliable crypto exchanges which can often lead to a loss of user funds. Tinaba needed to partner with the right crypto infrastructure to provide top-notch trading, custody, and security services to their clients.

Tinaba places a strong emphasis on safety and compliance, recognizing the importance of partnering with an organization that shares and upholds the same core values, ensuring a secure and trustworthy experience for their users.

In order to seize market share, Tinaba needed to act swiftly. Therefore, partnering with an already functional crypto infrastructure to provide safe and secure access to the decentralized world was a priority.

The crypto expertise necessary to maintain appropriate crypto infrastructure and regulatory compliance within the legal boundaries in Italy is one of the highest barriers to entry in the industry.

Why CheckSig

Due to the rapid evolution of the industry and the increasing interest in digital assets, Tinaba recognized the need to act swiftly and appropriately. This involved selecting a partner with a robust and flexible crypto infrastructure, capable of providing clients with secure crypto products while aligning with Tinaba’s core values.

CheckSig was chosen for its Proof-of-Reserves, segregation of assets, insurance coverage, SOC 1 and SOC 2 Type II attestations, and audits conducted by a Big 4 firm. These elements ensure the highest standards of security, transparency, and reliability for all crypto assets under management. Together, Tinaba and CheckSig will offer secure and trustworthy crypto services to the next generation of digital asset investors.

The solution

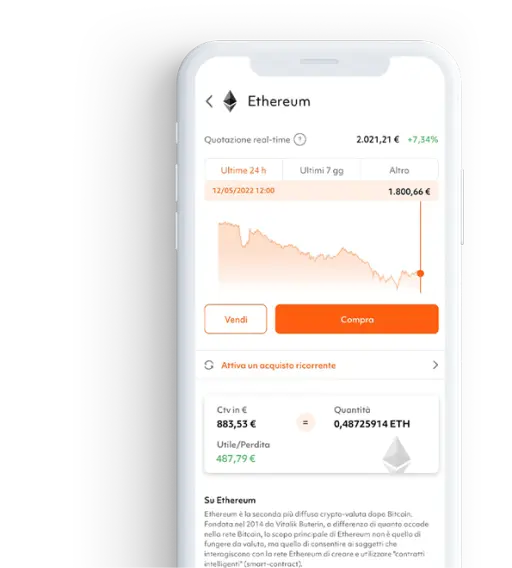

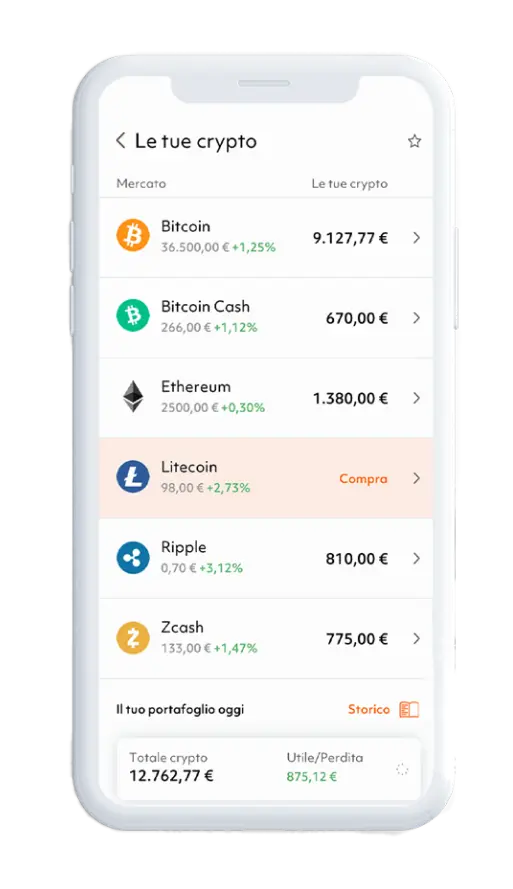

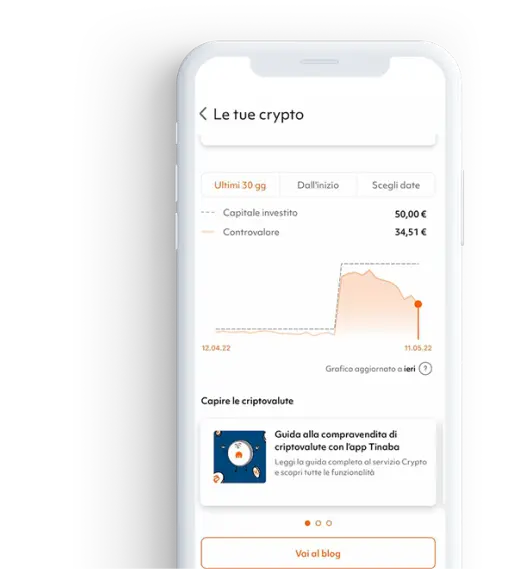

The partnership with CheckSig allowed Tinaba to offer reliable crypto solutions to its existing customer base. Users are now able to buy and sell Bitcoin and other crypto-assets directly through the app. Additionally, CheckSig provided multicoin smart order and professional custody through its infrastructure for institutional investors.