Halving: happy birthday Bitcoin!

April 23, 2024 - Ferdinando Ametrano

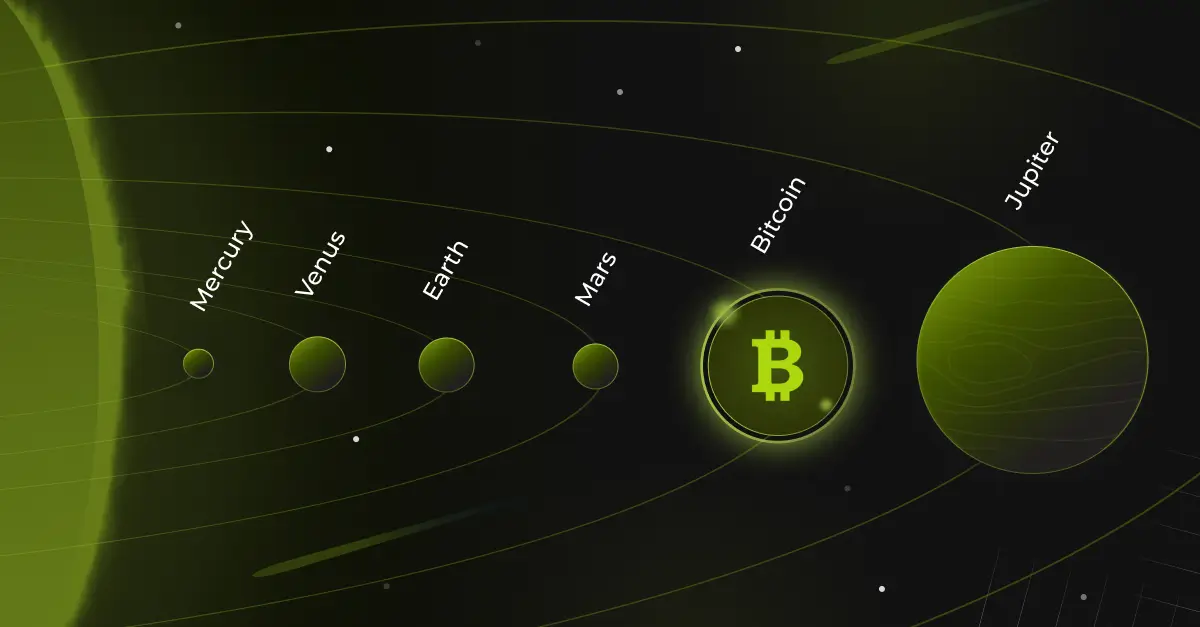

Last April 20th there was the halving, the phenomenon whereby every approximately 4 years the quantity of Bitcoins issued is halved. It is the fourth halving since the birth of Bitcoin in 2009 and is, therefore, its fourth birthday. In fact, for Bitcoin time is measured in “blocks” and 210,000 blocks are needed to complete a cycle, i.e. a Bitcoin year. A Bitcoin cycle lasts four Earth years, as if Bitcoin were a planet located in the solar system between Mars, where one year corresponds to just under two Earth years, and Jupiter, where one year corresponds to approximately twelve Earth years. With each new cycle the issuance of new Bitcoins is halved, in order to guarantee their progressive scarcity, and the fifth cycle that has just begun is characterized by the issuance of 3,125 Bitcoins per block.

What are blocks, blockchain and miners

This issue is used to reward the “miners”, i.e. the subjects who update the Bitcoin ledger, recording the transactions that take place on the network. This accounting book is called “blockchain”, a chain of blocks: if a paper register is made up of sheets, this one is instead a sequence of blocks. Each block contains multiple transactions, and miners add a new block approximately every ten minutes. Miners must use great computational power to create a new block: the miner who succeeds is rewarded with the issuance of new Bitcoins. Since the issue is recorded in the same block that has just been finalized, the miner who produced it is induced to be honest: if he produced a block containing invalid transactions, this would be rejected by the Bitcoin network and the miner would lose his remuneration, nullifying his Work. Furthermore, the computational effort spent to finalize a block becomes the guarantee that whoever wants to manipulate it must spend the same amount of energy and all that necessary to update the following blocks in the chain, a cost that quickly becomes unsustainable and makes the Bitcoin blockchain secure.

What happened on the market

In the past, halving has always coincided with bullish cycles, which is why some imagine that the phenomenon will repeat itself this time too. In reality, the halving is now quantitatively irrelevant: the bitcoins issued each year (the so-called “flow”) are negligible compared to the quantity in circulation (the “stock”). Therefore, even if miners have to sell part of the Bitcoins obtained to cover operating costs, this quantity does not significantly impact the volumes traded on the market. Furthermore, being a deterministic phenomenon, the halving was already totally incorporated into the Bitcoin price which, in fact, marked dizzying increases in 2023 and early 2024 but practically did not move during the halving. Today the halving is almost a marketing phenomenon or, indeed, a birthday party: just as everyone is involved in the event of the Olympics or the World Cup, even those who do not follow sport, similarly even those who do not follow Bitcoin every four years has seen its health and increased relevance.

The stock-to-flow ratio and what will happen in the market

If the halving was not significant news for the market price, it is instead very significant that following the latest issue halving the stock/flow ratio, used as a measure of relative scarcity, jumped to 120. With this leap Bitcoin has surpassed physical gold, for centuries the undisputed champion with a stock/flow of around 62. In short, Bitcoin is rarer than physical gold and this evidence is certainly intended to strengthen the understanding of Bitcoin as a safe haven rather than an investment merely speculative. Market prices have been dominated in recent months by the inflow of capital via the Bitcoin ETFs authorized at the beginning of the year. The entry occurred with an intensity that shattered any previous record and led Bitcoin ETFs to be second only to gold ETFs. It is possible to imagine a historic overtaking and therefore new price records for Bitcoin in the coming months.

What happened to the miners

Halving the reward for miners proportionally decreases their profitability and we have seen the effect in the prices of listed mining companies. However, we have not yet seen the decrease in the computational power used in their activity online. It would be obvious to expect hardware that is no longer profitable to be disposed of, but this disposal seems to have been postponed because profitability has not yet really decreased. On the one hand, the Bitcoin price has grown a lot in the last 15 months, on the other there has been a surprising and completely exceptional increase in Bitcoin transaction fees, collected by miners, which more than compensated for the halving of the issue. This surprise is due to the launch of the so-called “Rune”, an extension of the Bitcoin protocol that allows you to create objects other than Bitcoin but which can be exchanged with the same technology. It is likely that this innovation may lose interest and therefore value over time: in this area the Ethereum platform has a great advantage and those interested in Bitcoin digital gold do not look favorably on Runes.

The future of Bitcoin

The fifth Bitcoin cycle, which has just begun, promises to be characterized by the adoption by traditional finance of what until recently was seen as a controversial if not downright negative phenomenon. What the internet represented for information, Bitcoin will be for the transmission of value. If there is still evident resistance, the openings are now more evident: the entry of large international asset managers such as BlackRock and Fidelity, the suggestion of the international association of financial consultants to allocate 2.5% of the portfolio to Bitcoin, the The entry into force in Europe of the regulation on crypto-asset markets, the general clarification of the tax framework of the crypto phenomenon. In short, the dust of the (digital) gold rush that has so far characterized the Far West Bitcoin is settling, the new San Francisco and JP Morgan will be born, a Silicon Valley unimaginable today will arise. If at the beginning of the 2000s, despite having a clear relevance of the internet, it was difficult to imagine Amazon, Facebook, Google, Netflix or smartphones, today it is difficult to imagine what will become achievable in the next Bitcoin cycles. For now we can get by like this: happy birthday Bitcoin, thirty more of these cycles!