CheckSig Survey: 68% of Italians want crypto services from their bank

June 17, 2025 - Staff

CheckSig’s latest survey reveals Italians’ growing interest in the crypto market, balancing a desire to invest with a need for security, and outlines a major opportunity for the banking sector.

Milan, June 17, 2025 – CheckSig, a company specialized in crypto-asset trading and custody solutions, has released the findings of the CheckSig Survey, a study exploring the expectations of Italian investors regarding the crypto market. The results show a clear trend: Italians want to invest in crypto, and they want to do it with the support and security of their bank.

Italians are ready to invest in crypto, but through their bank

The survey paints a clear picture: most Italians are showing growing interest in the crypto world and are considering investing in the near future. However, they prefer to do so consciously and securely, through a trusted financial intermediary like their bank. A striking 68% of respondents said they would like their bank to offer crypto-related services, underscoring the trust placed in financial institutions as reliable partners, even regarding financial innovation.

This demand is not just theoretical—it may soon translate into real market shifts: 48% of Italians said they would be willing to open an account with a different bank if it offered crypto services. This is a strong signal: the presence or absence of crypto offerings could become a decisive factor in choosing a financial provider.

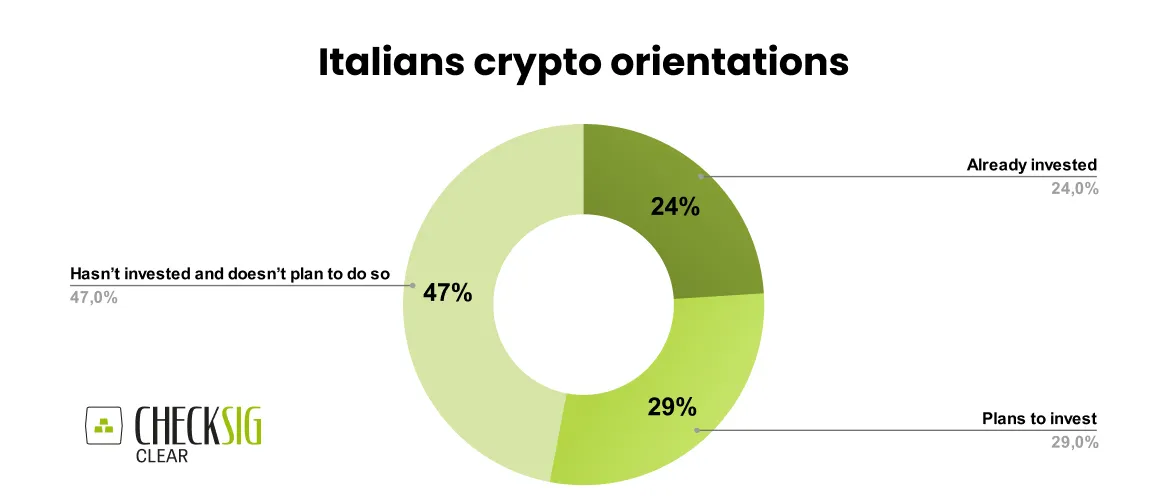

The study also reveals that 24% of Italians have already invested in crypto, and another 29% plan to do so in the near future. These numbers point to a significant level of adoption and a high growth potential that far exceeds the current market. Among those who have already invested, 47% hold a crypto position exceeding €10,000, indicating a deliberate and significant allocation, rather than a casual or exploratory investment.

An opportunity banks can’t afford to miss

Italians’ increasing interest in crypto is not just a shift in investor behavior; it’s a concrete opportunity for banks to redefine their role within a rapidly evolving financial ecosystem. Offering crypto services is no longer just an optional innovation, but a key competitive advantage in a market that’s leaning more and more toward digital solutions.

For Italian banks, meeting this emerging demand means strengthening customer relationships and positioning themselves at the center of a transformation that can attract new client segments and build loyalty among existing ones. While 53% of respondents say they have already invested or plan to, this figure jumps to 68% when banks are the ones offering crypto services. Giving clients safe, regulated access to crypto-assets could help institutions meet a real and growing need.

In a context where 71% of respondents who want crypto services from their bank say they would open an account specifically to access them, the ability to innovate becomes a strategic factor for competitiveness. Customer expectations are clear: simplicity, security, and expert guidance.

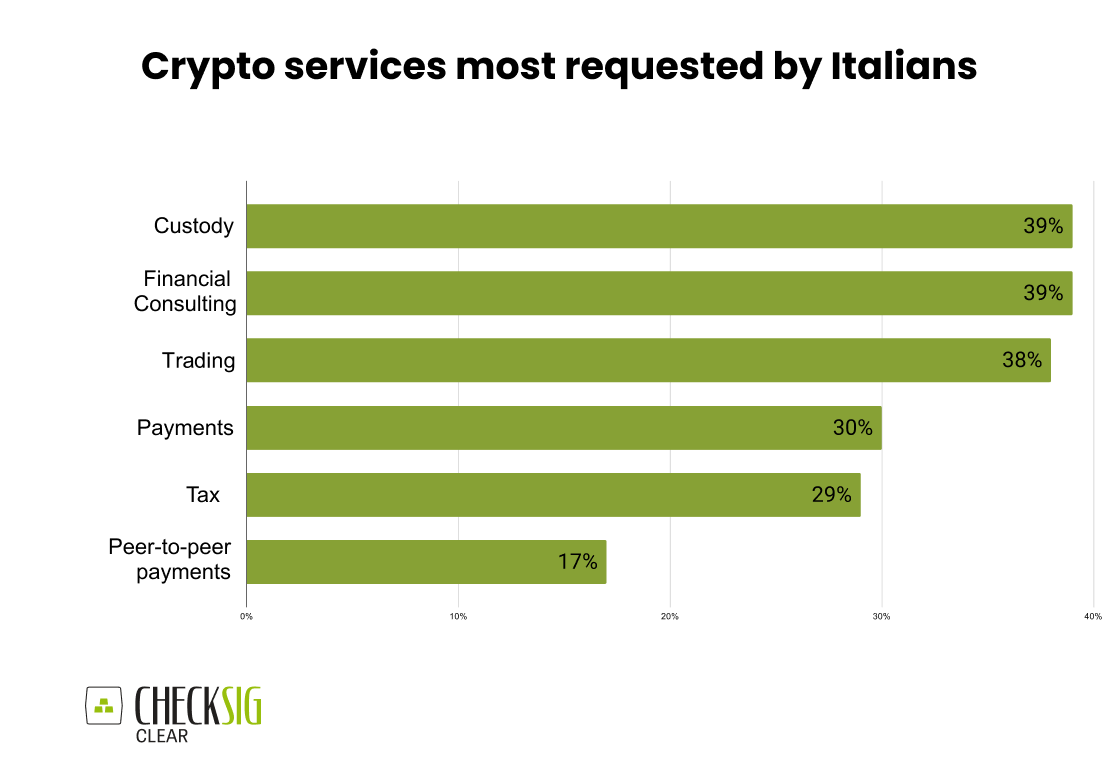

The most frequently cited needs, each selected by 39% of respondents, are having a secure custody solution and access to an expert advisor who can help navigate the crypto market. Another 38% consider it essential to be able to buy and sell crypto-assets safely, while 30% want to use their crypto to make purchases or benefit from integrated tax reporting. Finally, 17% are interested in being able to send crypto to other users.

Safety and trust: banks at the center of Italians’ crypto journey

”These numbers speak for themselves: there is a strong demand for tools and services that allow people to operate in crypto safely, transparently, and in a regulated environment,” said Michele Mandelli, Managing Partner at CheckSig. ”And the preferred channel for meeting this demand is the banking system: Italians are asking for a trustworthy intermediary to support them at every step, from investment decisions to custody and tax reporting.”

Security remains a key consideration for Italians when planning crypto exposure. Respondents highlighted the importance of relying on a solid and regulated partner, like their bank, to navigate what is still often perceived as a complex and risky market. ”In the crypto world, Italians want to feel safe. And the answer is: their bank,” Mandelli concluded.

Methodology

The CheckSig Survey explores Italian customers’ expectations in the crypto market, focusing on the growing demand for bank-integrated crypto services that help users navigate this space securely.

The study focused on knowledge, behavior, and expectations related to crypto-asset investment, as well as perceptions of the banking sector’s role in this space. The research was conducted using CAWI methodology (Computer-Assisted Web Interviewing) between March 3 and March 10, 2025. The sample included 1,000 employed Italians aged 20 to 60, representative by gender, geographic area, and income bracket.

The full survey results are available on the CheckSig Clear website.

For more information, visit clear.checksig.com.

About CheckSig

CheckSig is an Italian company providing access, custody, and tax solutions for crypto-assets, operating under the highest standards of security, transparency, and regulatory compliance. CheckSig supports investors, professionals, and financial institutions in accessing a safe, reliable, and fully integrated crypto ecosystem.

In 2024, CheckSig launched CheckSig Clear, a technology infrastructure that enables banks and intermediaries to offer simple and secure access to crypto-assets.