Solutions

Clients

Security and Compliance

About

Turnkey Solutions for the Financial Institutions Ecosystem

A Crypto-as-a-Service platform that offers secure, compliant, and effortless access to the crypto world while enhancing the client experience

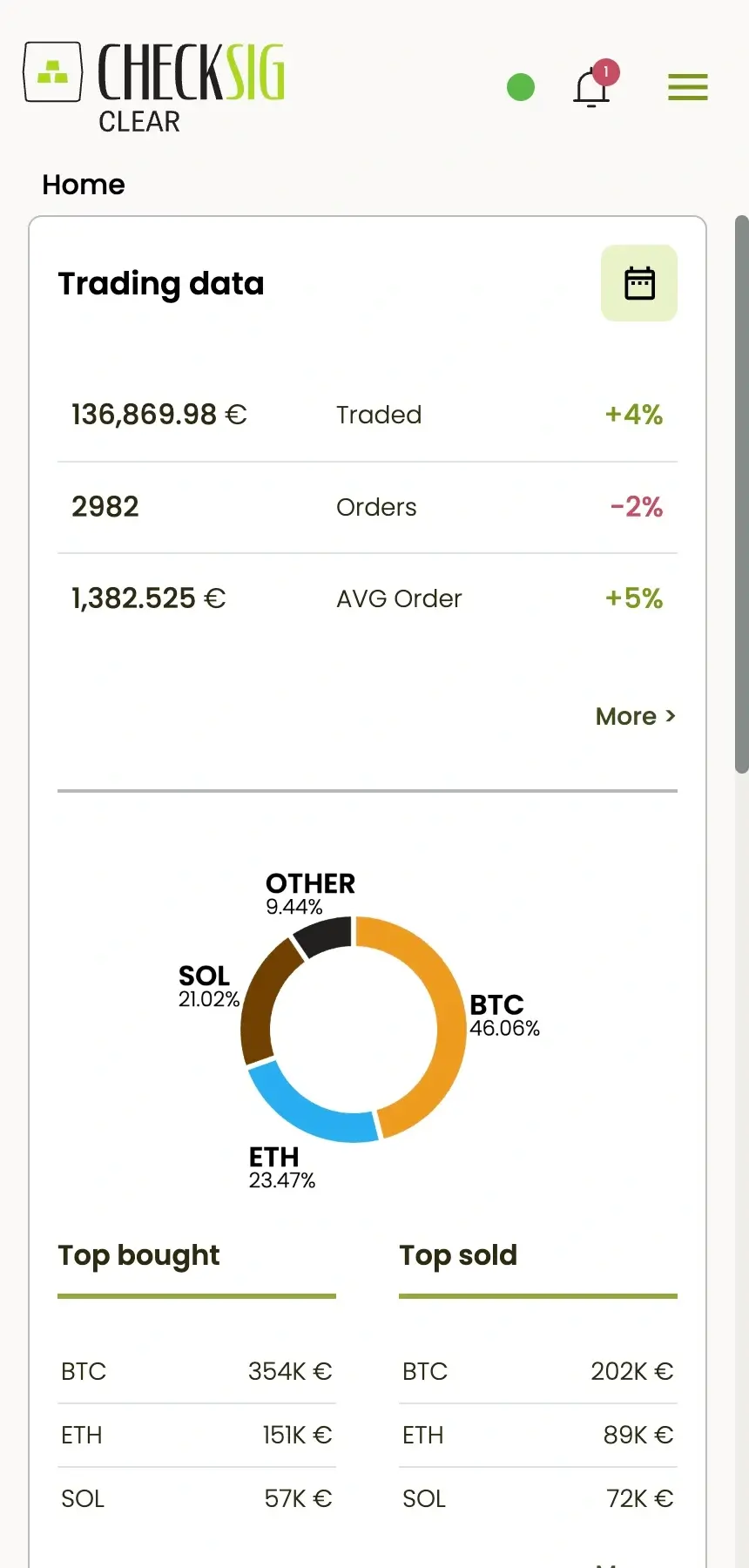

Market Access

- Multi-venue access

- Smart order routing

- Best execution

- Post-trade settlement

- OTC desk

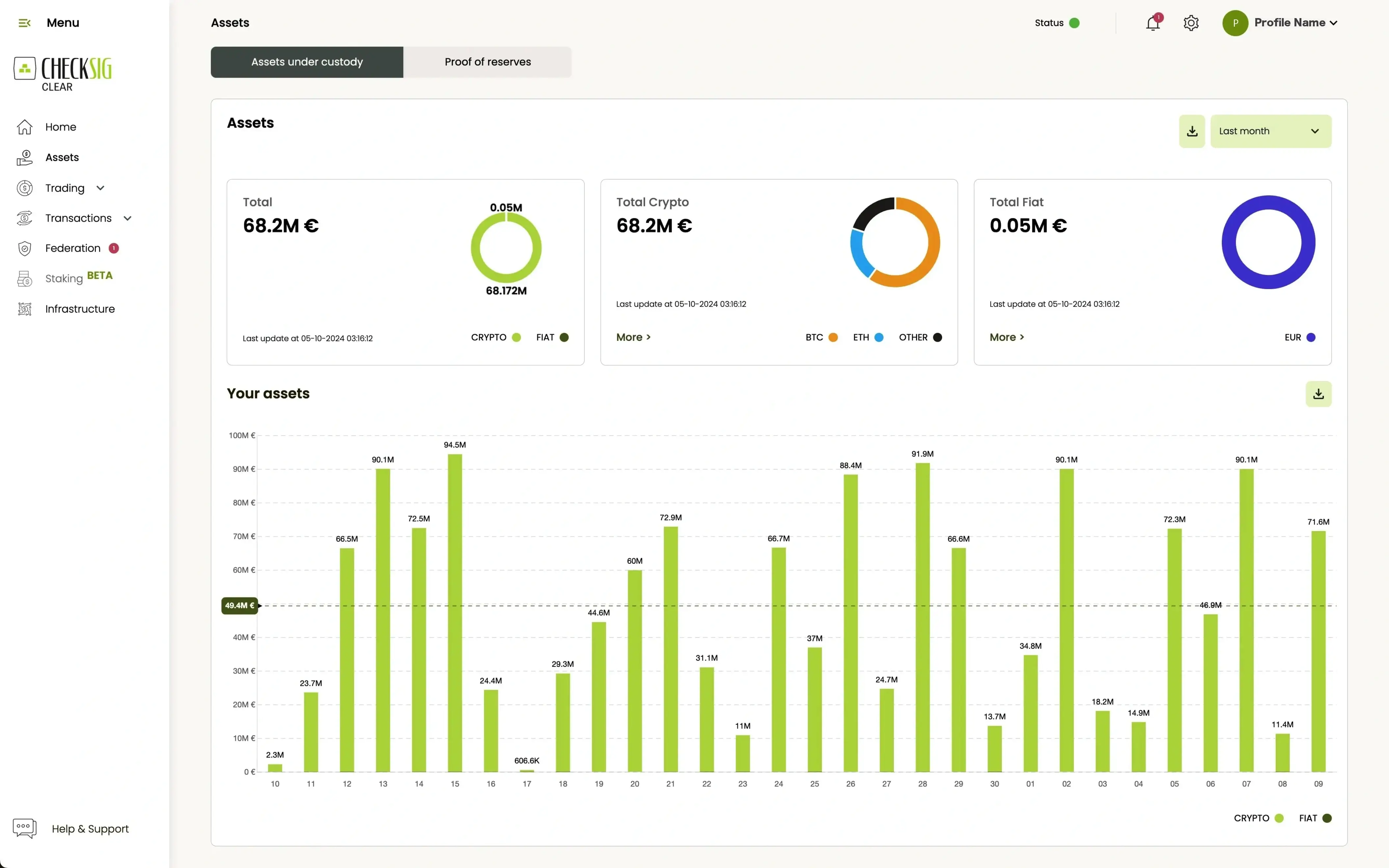

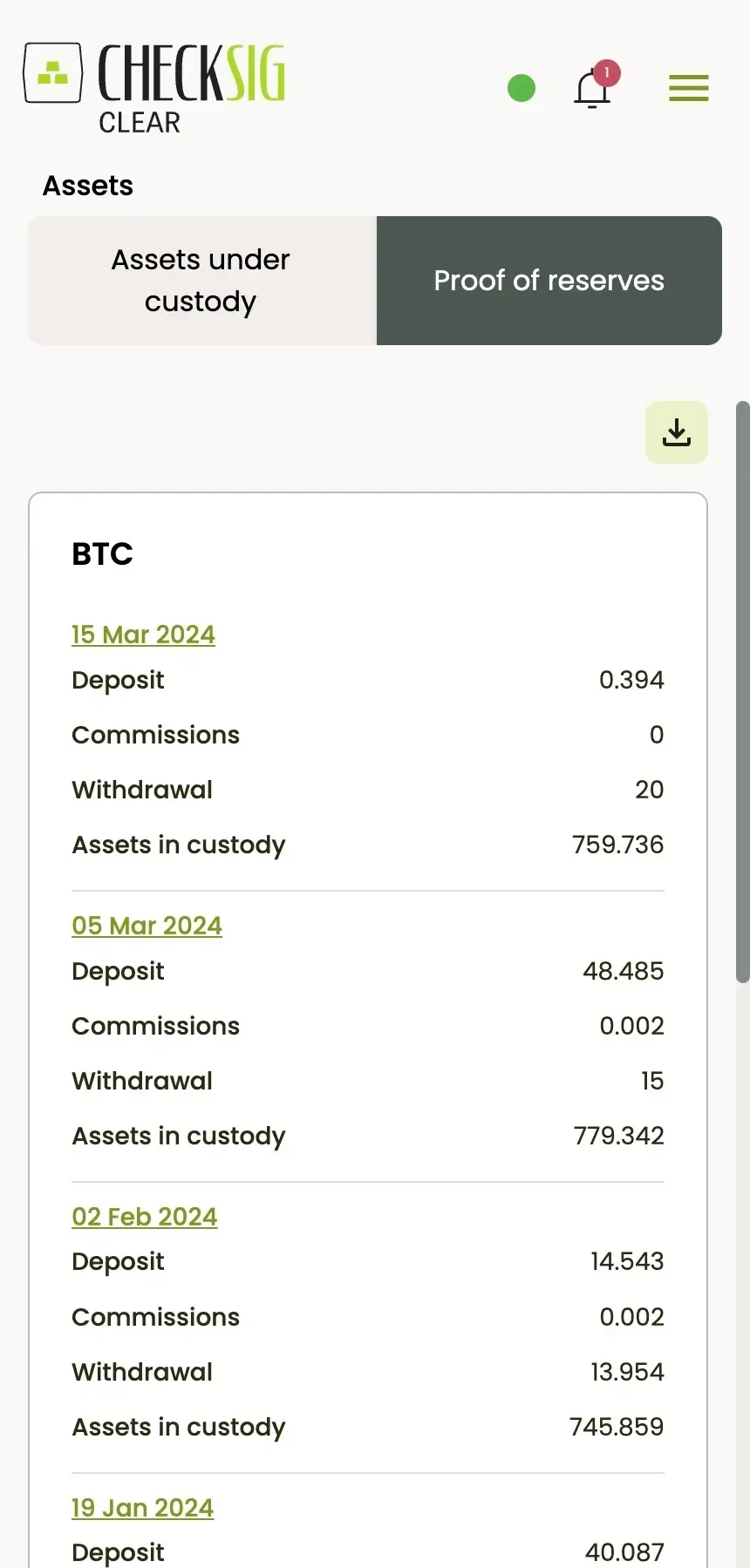

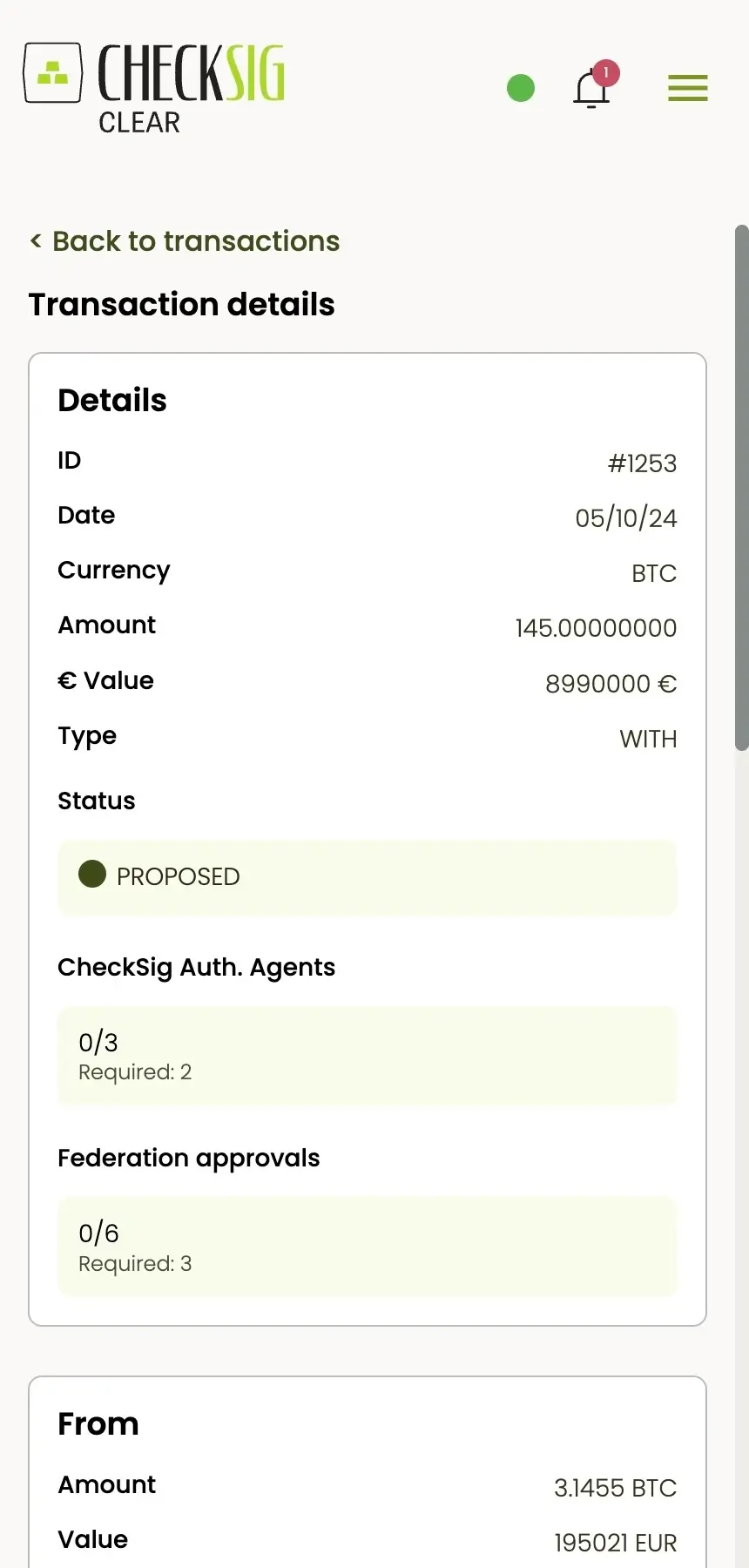

Institutional Custody

- Collaborative custody design

- Multi-level architecture

- Custom vault solutions

- Proof-of-Reserves

- Escrow accounts

Tax and Compliance

- Integrated tax engine

- Withholding management

- Custom tax reporting

- AML and CFT compliance

- Regulatory expertise

Research and Data

- Real-time market data

- Training curricula

- In-depth analysis

- Customized learning paths

- Operational dashboards

Recognitions and Awards

A best in class service provider, leading responsible innovation

Seamless Integration of Digital Asset Services

Effortless scaling through flexible one-stop infrastructure

Retail and Private Banks

High-security and compliant vault solutions for digital assets

Neobanks and Fintech

Creation of new revenue streams and expansion of the user base

Brokers and Trading Platforms

Trading and OTC services with a plug-and-play approach

Asset Managers

Fiduciary responsibility upheld with operational efficiency

Banking-as-a-Service Platforms

Modular service extension with broad crypto infrastructure

Lenders

Escrow accounts powering collateralized credit solutions

News and Insights

Bitcoin Passes 20 Million Issued as the Final Million Stretches Over a Century

On March 9, 2026, bitcoin issuance passes the 20 million mark. About 95% of the maximum supply has now been issued, yet it will take more than a century to complete the final million.

CheckSig partners with SheTech to advance Gender Equality in the crypto industry

The goal is to reduce barriers to entry and promote a more representative and informed culture of innovation.

The Myth of Bitcoin Being Vulnerable to Quantum Computers

Despite alarmist headlines, the threat quantum computers pose to Bitcoin remains theoretical today. The required technology does not yet exist, and a transition to post-quantum systems can be planned.

Bitcoin in European banks: the Intesa Sanpaolo case confirms an ongoing trend

From Bitcoin ETFs to MiCA licenses, the integration of crypto-assets into traditional finance is accelerating.